How to Budget: A Comprehensive Guide to Managing Your Finances

Table of Contents

Budgeting is the cornerstone of financial stability. Whether you’re trying to save for a significant purchase, reduce debt, or simply ensure you’re living within your means, understanding how to budget effectively is essential. This guide will walk you through everything you need to know about creating and maintaining a budget, ensuring that you’re in control of your finances.

What is a Budget?

A budget is a financial plan that outlines expected income and expenses over a specific period. It helps you allocate resources effectively, ensuring you have enough money for necessary expenses while setting aside funds for savings and future goals. By tracking your spending, a budget allows you to identify areas where you may be overspending and adjust accordingly.

How to Budget Money

1. Determine Your Income

The first step in creating a budget is determining your total income. This includes your salary, bonuses, freelance income, and any other sources of regular income. Knowing exactly how much money you have coming in each month is crucial for setting realistic spending limits.

2. List Your Expenses

Next, list all your monthly expenses. These should be categorized into fixed expenses (e.g., rent, mortgage payments, utilities) and variable expenses (e.g., groceries, entertainment, dining out). Don’t forget to include irregular expenses like annual insurance premiums or car maintenance.

3. Set Financial Goals

Establish clear financial goals to guide your budgeting efforts. Whether it’s saving for a vacation, paying off debt, or building an emergency fund, having specific targets will motivate you to stick to your budget.

4. Track Your Spending

To ensure you’re sticking to your budget, track your spending throughout the month. You can use apps, spreadsheets, or even a simple notebook. Regularly comparing your actual spending to your fund amounts will help you stay on track.

5. Adjust as Necessary

Life is unpredictable, and your budget should be flexible enough to accommodate changes. If you find that you’re consistently overspending in certain areas, adjust your pool to reflect your actual spending habits. Conversely, if you have extra money left over each month, consider putting it toward your savings or investing it.

How to Make a Budget

1. Start with Your Net Income

Your net income is the money you have left after taxes and other deductions. This is the amount you should base your financial estimate on, as it’s the actual money you have available to spend.

2. Categorize Your Expenses

Divide your expenses into categories such as housing, transportation, groceries, entertainment, and savings. This will help you see where your money is going and identify areas where you can cut back.

3. Allocate Funds

Once you have your expenses categorized, allocate a portion of your income to each category. Be realistic and ensure that your financial estimate aligns with your financial goals.

4. Review and Revise

Regularly review your pool to see if it’s working for you. If you find that certain categories are consistently over or reasonable, make adjustments as needed.

How to Create a Budget

Creating a budget requires a systematic approach. Here’s a step-by-step guide:

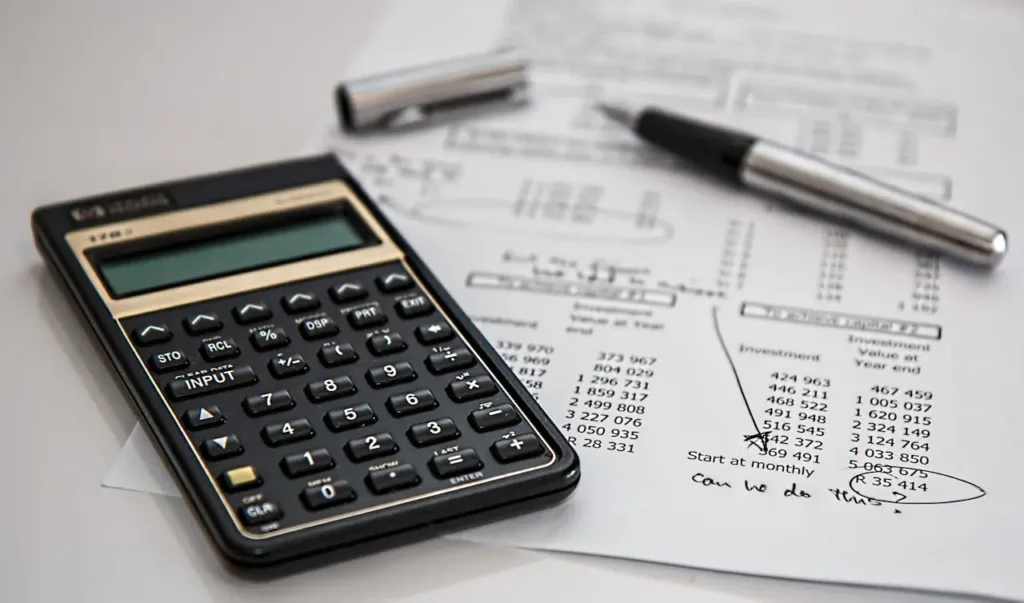

1. Gather Financial Statements

Start by gathering all your financial statements, including bank statements, credit card bills, and receipts. This will give you a clear picture of your spending habits.

2. Calculate Your Monthly Income

Add up all your sources of income to determine your total monthly income. This figure will serve as the foundation of your fund.

3. List Monthly Expenses

Make a comprehensive list of all your monthly expenses, including fixed and variable costs. Be thorough, and don’t forget to include occasional expenses like gifts or medical bills.

4. Subtract Expenses from Income

Subtract your total monthly expenses from your monthly income. If you have money left over, consider putting it into savings or paying down debt. If your expenses exceed your income, you’ll need to find ways to cut back.

5. Set Up a Budgeting Tool

To keep track of your fund, use a tool like a spreadsheet, app, or financial software. These tools can help you monitor your spending and ensure you’re sticking to your financial pool.

How to Eat Healthy on a Budget

Eating healthy doesn’t have to be expensive. Here are some tips to help you maintain a nutritious diet without breaking the bank:

1. Plan Your Meals

Planning your meals in advance can help you avoid impulse purchases and reduce food waste. Create a weekly meal plan and stick to your shopping list to stay within your pool.

2. Buy in Bulk

Purchasing staples like rice, beans, and oats in bulk can save you money in the long run. Look for bulk bins at your grocery store and stock up on non-perishable items.

3. Choose Seasonal Produce

Seasonal fruits and vegetables are often more affordable and fresher than out-of-season produce. Visit your local farmers’ market or look for sales at your grocery store.

4. Cook at Home

Eating out is more expensive than cooking at home. Preparing meals at home allows you to control the ingredients and portion sizes, which can help you eat healthier and save money.

5. Limit Processed Foods

Processed foods are often more expensive and less nutritious than whole foods. Focus on buying whole ingredients and preparing meals from scratch.

How to Make a Budget-Friendly Wellness Plan

Maintaining your health and wellness doesn’t have to be costly. Here’s how to create a inexpensive wellness plan:

1. Prioritize Your Health Goals

Determine your top health priorities, whether it’s improving your diet, increasing physical activity, or reducing stress. Focus on the areas that matter most to you.

2. Utilize Free Resources

There are plenty of free resources available to help you stay healthy, from online workout videos to meditation apps. Take advantage of these tools to support your wellness journey without spending money.

3. Create a Home Workout Routine

You don’t need a gym membership to stay fit. Create a home workout routine using bodyweight exercises or inexpensive equipment like resistance bands.

4. Practice Mindfulness

Mindfulness and meditation are effective ways to reduce stress and improve mental well-being. Practice mindfulness techniques at home using free apps or online resources.

5. Cook Nutritious Meals at Home

As mentioned earlier, cooking at home is a great way to eat healthily. Focus on incorporating nutrient-dense foods into your meals to support your overall wellness.

Where Does the Budget on a Movie Go?

The financial estimate of a movie is divided into several key areas:

1. Pre-Production

This includes costs associated with script development, casting, location scouting, and hiring the crew. Pre-production expenses set the foundation for the movie and can take up a significant portion of the finance.

2. Production

Production costs cover everything from filming equipment and set design to costumes and makeup. This is typically the most expensive phase of movie-making, as it involves paying the cast, crew, and renting or purchasing necessary equipment.

3. Post-Production

After filming is complete, the movie enters post-production. This stage includes editing, sound design, special effects, and music composition. Post-production costs can vary depending on the complexity of the film.

4. Marketing and Distribution

Finally, a portion of the movie’s pool is allocated to marketing and distribution. This includes promoting the film through trailers, posters, and advertising, as well as distributing it to theaters or streaming platforms.

How to Eat in New York on a Budget

New York City is known for its expensive dining options, but it’s possible to enjoy delicious meals without breaking the bank. Here’s how:

1. Explore Food Trucks and Street Vendors

New York is famous for its food trucks and street vendors, offering everything from hot dogs to international cuisine. These options are often more affordable than sit-down restaurants.

2. Visit Local Markets

Farmers’ markets and food halls in New York offer fresh and affordable options. You can find everything from fresh produce to ready-to-eat meals at reasonable prices.

3. Take Advantage of Happy Hour Deals

Many restaurants and bars in New York offer happy hour deals with discounted food and drinks. Plan your meals around these times to save money.

4. Eat at Ethnic Restaurants

New York is home to a diverse array of ethnic restaurants, many of which offer authentic and affordable meals. Explore neighborhoods like Chinatown, Little Italy, and Queens for budget-friendly dining options.

5. Opt for Lunch Specials

Many restaurants offer lunch specials that are cheaper than their dinner menus. Eating out for lunch instead of dinner can help you save money while still enjoying a great meal.

How to Set Up a Google Spreadsheet for Budgeting

Google Sheets is a powerful tool for budgeting. Here’s how to set up a simple budgeting spreadsheet:

1. Create a New Spreadsheet

Open Google Sheets and create a new spreadsheet. Title it something like “Monthly Budget” to keep it organized.

2. Set Up Income and Expense Categories

In the first column, list your income and expense categories (e.g., Income, Rent, Utilities, Groceries, Entertainment). In the second column, enter your financial estimate amounts for each category.

3. Add Formulas

Use simple formulas to calculate your total income and expenses. For example, use =SUM(B2:B10) to calculate the total of your expenses.

4. Track Your Spending

As you spend money throughout the month, enter the amounts in the spreadsheet. Use conditional formatting to highlight categories where you’re over budget.

5. Review and Adjust

At the end of the month, review your spending and compare it to your budgeted amounts. Make adjustments as necessary for the following month.

Here are some external resources that you might find helpful:

- Mint: Personal Finance, Budgeting, and Investment Tools – A comprehensive tool for budgeting and managing your finances.

- Dave Ramsey: Budgeting 101 – An expert guide on how to start budgeting and manage your money effectively.

- NerdWallet: How to Make a Budget – A step-by-step guide to creating a budget that works for you.

- MyFitnessPal: Eating Healthy on a Budget – Tips and tricks for maintaining a nutritious diet without overspending.

- Google Sheets: Budget Template – Use Google Sheets’ budget templates to easily track your expenses and income.

- NYC Go: Budget Dining in New York City – A guide to affordable eating options in New York City.

These resources provide additional information and tools to help you with budgeting and managing your finances effectively.